Greek election: Five questions for markets

Greece votes on Sunday in what is likely to be an inconclusive election, meaning short-term uncertainty as markets wait to see whether a coalition government or a second-round vote follows.

Incumbent Prime Minister Kyriakos Mitsotakis’ strong relationship with the European Union and commitment to reforms should reassure investors if he is successful. An economy in a strong shape means a win for the opposition leftist SYRIZA Party might not unnerve markets as it did when it won in 2015.

“It’s [Greece] gone from being on the brink of being kicked out of the eurozone in 2015 to a situation where nobody is seriously worried in the near term,” said Capital Economics’ chief Europe economist Andrew Kenningham.

Here are five key questions for markets.

1/ What is the biggest issue for voters?

The cost-of-living crisis, with inflation eroding consumers’ purchasing power.

Inflation rose to as high as 12.1% in September and has since slowed to 4.5% on an annual basis, as energy prices fall. Average annual wages are still around 25% below their peak from 2009, OECD data shows.

“You’ve seen a huge compression of salaries over the last 10 years and people have really felt the pinch,” said Wolfango Piccoli, co-president at financial advisory firm Teneo.

2/ What does the election mean for Greece’s return to investment grade?

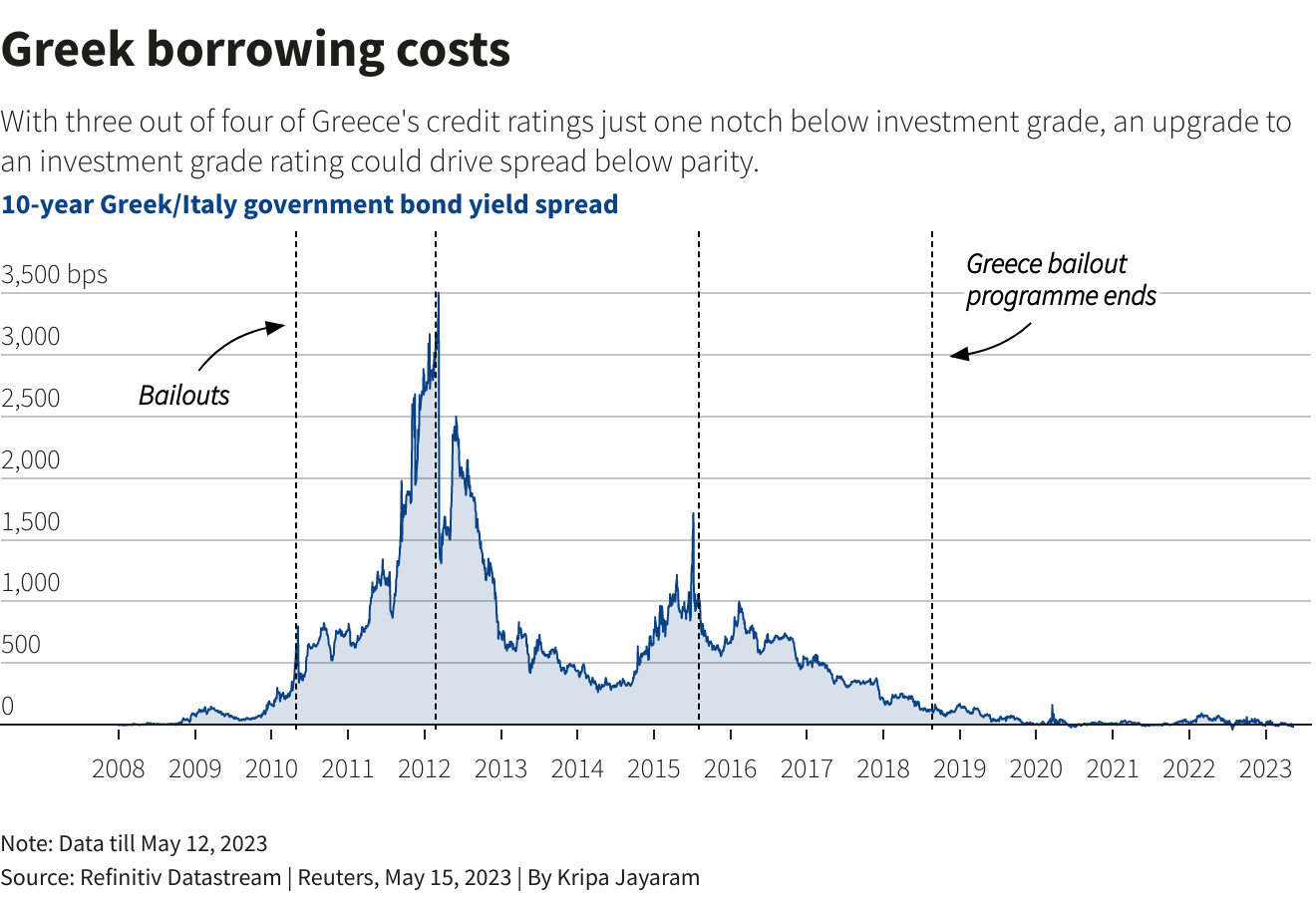

With three of four of its credit ratings just one notch below investment grade, the election may be the final hurdle before Greece regains the status it lost over a decade ago.

S&P Global has said it could upgrade Greece’s BB+ rating within the next year if a new government maintains fiscal discipline and the pace of reforms which unlock EU recovery funds.

Goldman Sachs says a delivery on Mitsotakis’ plan to roughly triple its spending of EU funds this year could be the “final step” to an upgrade.

Greece’s long-term borrowing costs, at around 4%, are already below Italy’s and an investment-grade rating would likely drive them lower.

But much of the good news for Greece’s rating may already be priced in, BlueBay Asset Management portfolio manager Kaspar Hense said.

3/ Will investors ditch Greek assets if Mitsotakis loses?

Unlikely. Investors view Mitsotakis as a steady hand, given his strong relationships with the United States and Brussels, but opinions of SYRIZA have changed greatly since the financial crisis. Greece also enjoys one of the best euro area growth rates.

“Investors are looking for political stability first, and they will welcome the return to government of Mitsotakis,” Teneo’s Piccoli said, adding “he is clearly pro-market.”

A SYRIZA-led government could hurt sentiment but a repeat of 2015, when SYRIZA’s win sent Greek stocks slumping 24% that year and Greek 10-year yields to 19%, is seen as unlikely.

“SYRIZA has become much more mainstream after being in government so there is little probability we see another replay of the 2015 volatility,” said Mazars Wealth Management chief economist George Lagarias.

4/ What does the election mean for Greek shares?

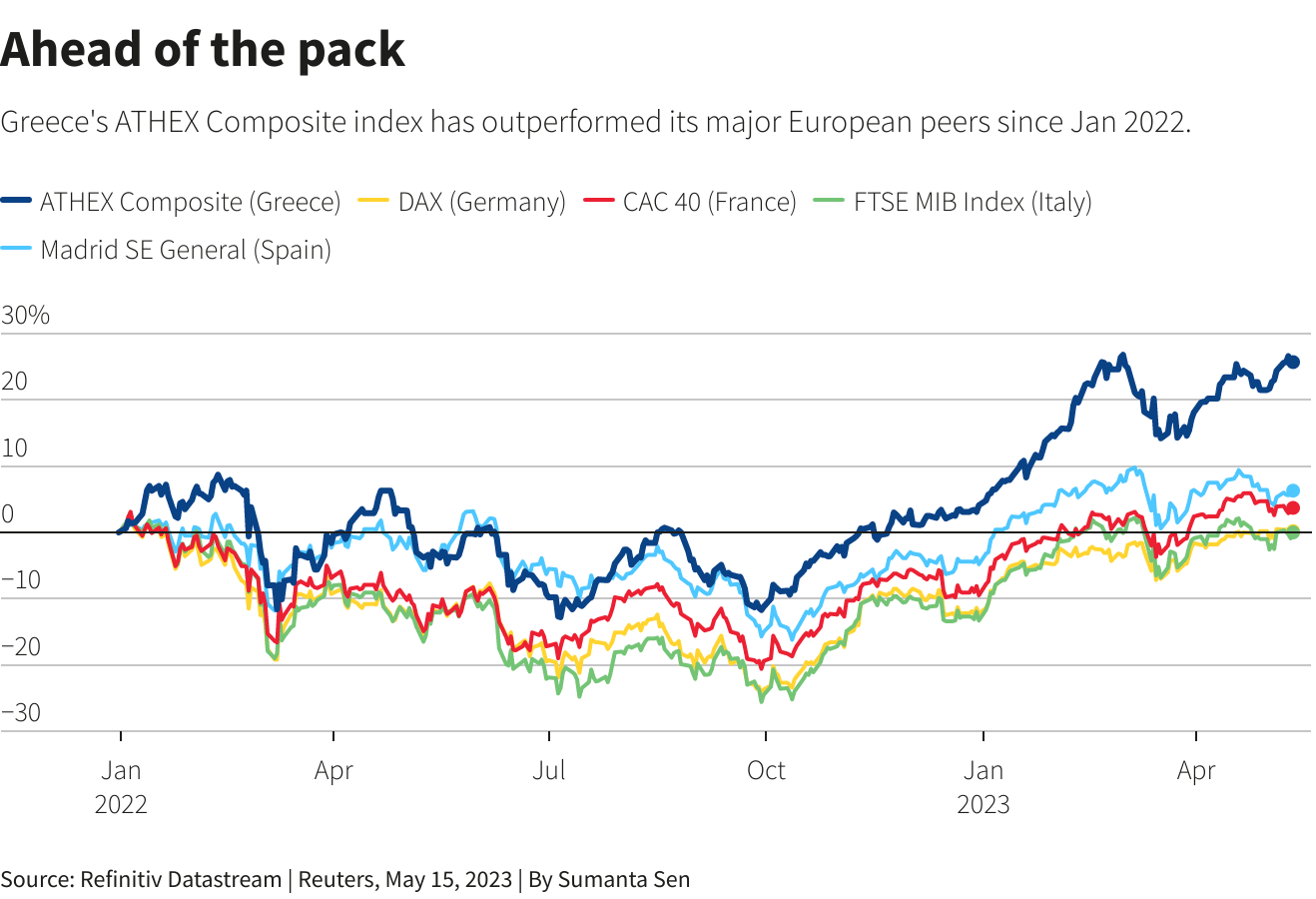

A decisive win for either party could add to short-term outperformance.

Greece’s ATHEX index (.ATG) is up around 21% so far this year, Europe’s STOXX 600 (.STOXX) has rallied 10%. Its skew towards banks, boosted by rising interest rates, helps explain the Greek outperformance.

Investors will watch government plans for the disposal of its stakes in Greek banks.

The state-owned Hellenic Financial Stability Fund, founded during the debt crisis, says it will shed its bank stakes by end-2025. It owns roughly 40% of National Bank of Greece (NBGr.AT), 27% of Piraeus (BOPr.AT), 9% of Alpha Services and Holdings (ACBr.AT), and 1.4% of Eurobank (EURBr.AT).

“The good news is that after the elections and return to investment grade … there will be a lot more interest and better valuations (for banks),” said Al Alevizakos, managing director, research for AXIA Ventures Group.

5/ What about the euro?

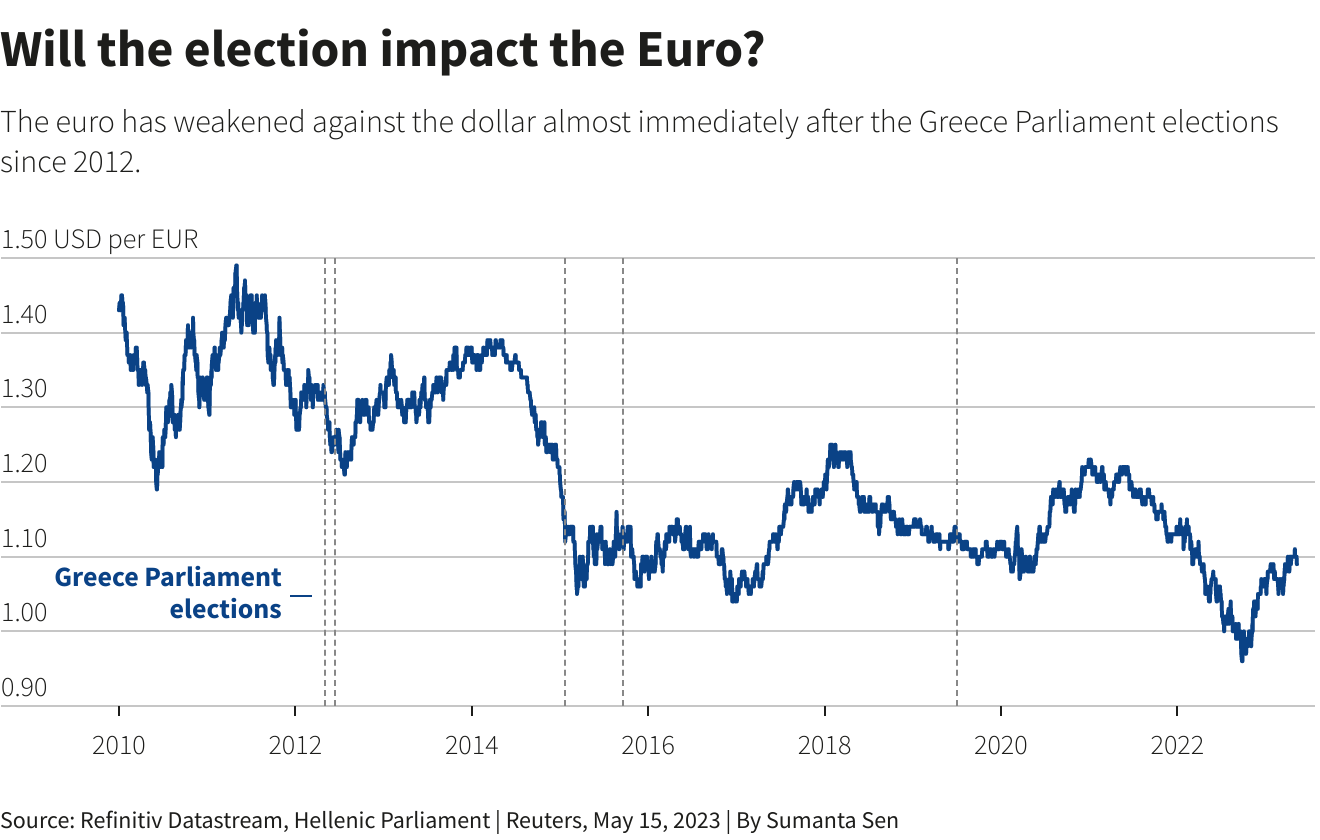

A trigger for selling the euro in the past, the election is not a big deal for FX traders this time.

Stronger cohesion, the EU recovery fund and an ECB emergency bond-buying tool have eased concerns about a euro zone breakup.

“The whole ‘peripheral pressures’ issue has really gone on the back burner,” said Adam Cole, head of FX strategy at RBC Capital Markets.

The euro is one of the best performing G10 currencies this year, up over 1.5% to $1.087.

[Reuters]